Srettha tackles water issues and development in Surin

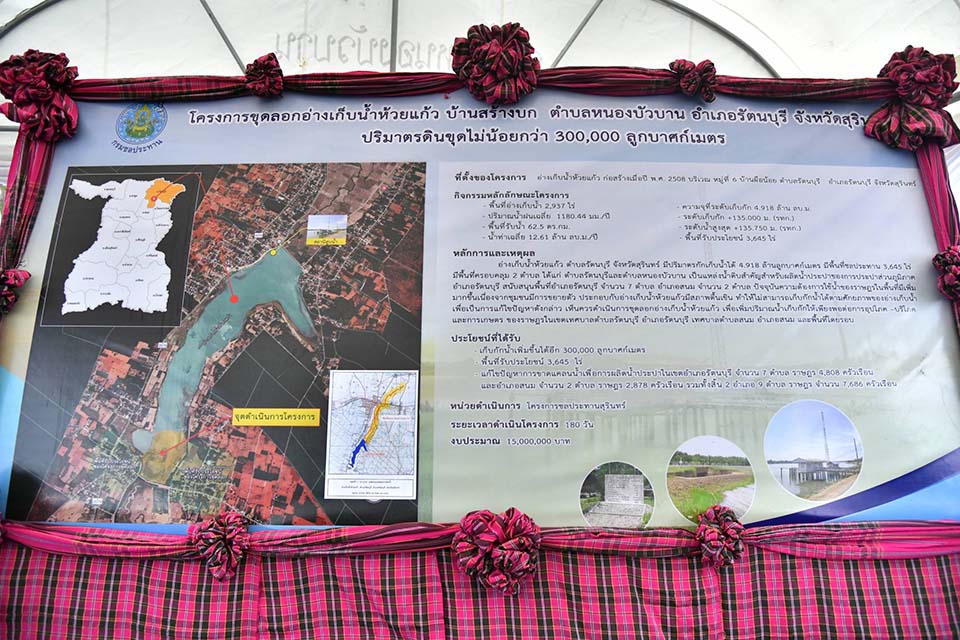

Prime Minister Srettha Thavisin is visiting Surin province today (June 30) to engage in critical discussions concerning the region’s development, starting with an evaluation of the Huai Kaew Reservoir. This key water body, integral for agriculture in three districts, faces significant challenges due to siltation, which has reduced its water capacity and exacerbated shortages during the dry season.

During his visit, the prime minister attended a meeting focused on a proposed dredging project to increase the reservoir’s capacity. The project is crucial for ensuring consistent water availability for both consumption and agricultural purposes, addressing one of the most pressing issues affecting the area’s sustainability and productivity.

Srettha’s trip continued to the Rattanaburi District Office to discuss a series of initiatives, including improving water resource management through enhanced dredging techniques and the strategic upgrade of the Chong Chom border checkpoint, considering environmental conservation constraints.

The meeting also covered exploring the establishment of Surin Airport to foster regional economic growth and proposing to boost the local economy by enhancing high-quality livestock production, especially Wagyu beef. (NNT)

Go to Source

Author: Pattaya Mail

Analysis – Thailand’s stock market is ‘bottoming’ out despite investor’s sentiments remaining subdued

It is a known fact that the performance of the stock market of a country is the reflection of the way things are going to be in the next 6-12 months, but it is also a known fact that market exuberance and/or pessimism sometimes push the markets to overshoot their fundamental values.

If the performance of the Stock Exchange of Thailand (SET) is to be taken as the bellwether for the future of the economic condition of Thailand, then it would all be a gloom and doom, but the economic data being released and key strategists in the country are already making calls that the SET Index may be already bottoming out within the month of July 2024.

Thailand’s SET Index ended the 1st half of the year at 1,300.96 points, down 114.89 points from the start of this year (2024) and if one looks at the performance over the past 18-months (since January 2023) the SET Index is down 22.04%.

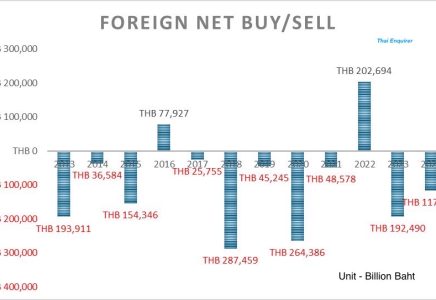

One of the key reasons given for the continued decline in the SET Index has been the continued exodus of foreign investors. Foreign investors have been net sellers of more than 117 billion Baht worth to equities so far in the 1st half of 2024.

The 117 billion Baht net sell position by foreigners is only part of the more than 1 trillion Baht of net selling that foreign investors have undertaken in the past 1-decade.

Economists and analysts say that Thailand’s continued lack of economic momentum and long-term growth potential has pushed investors to look at other markets, and to make matters worse the continued decline in the Thai Baht against the US Dollar has only expedited their exit.

SET Index is not only one of the worse performing stock markets in the region but also one of the worst in the world at the moment. To top this off, Thai Baht is also the currency that has depreciated the most after Japanese Yen against the greenback.

“The picture is different for Asia FX (foreign exchange) which are on track for losses for a second straight quarter. While most Asia FX continued to bear the brunt of the “higher-for-longer” Fed rhetoric, intensifying efforts by Chinese authorities to stablise its economy helped limit the downside risks to the CNY and spillover to the other regional peers. We have also seen some Asian central banks step up efforts to smooth currency volatility,” Singapore’s UOB said in a note to clients titled ‘Quarterly Global Outlook 3Q 2024’.

After weakening in the 1st half of 2024, UOB said that it expects Asia FX to recover modestly in H2 (2nd half) 2024 as the headwinds that previously weighed on regional currencies turned into tailwinds. Firstly, the USD is expected to gradually lose its interest rate advantage, hence weaken anew as the Fed kickstarts its rate cut cycle in Sep. Secondly, a brighter economic outlook for China in H2 2024 is expected to underpin a CNY and broad Asia FX recovery.

UOB said that they have recently upgraded China’s 2024 GDP forecast to 5.1% from 4.8% as the government unveiled more measures to boost growth, particularly on the fiscal front

UOB said that there is a probability that the Asian currencies may see some recovery during the 2nd half of the year, especially the Chinese Yuan, which would indirectly help the Thai Baht.

The THB fell over 7% year-to-date to 36.80/USD, one of the worst performing Asia FX as Bank of Thailand (BoT) rate cut expectations build. Outflows from the local stock and bond markets also weighed on the THB.

“The weak THB may have already priced in part of the front-loaded BoT 25 basis points rate cuts in June and August.”

UOB said that as such, a broad-based Asia FX recovery in 2nd half of 2024 led by the CNY may help THB pare year-to-date losses.

“Overall, our USD/THB forecasts are 36.20 in 3Q24, 35.80 in 4Q24, 35.40 in 1Q25 and 35.00 in 2Q25.”

Recovering Economy

The recovering economy is likely to help drive investors back to the invest in the Stock Exchange of Thailand (SET), and the data released by the BoT for the month of May 2024 on Friday, showed that the Thai economy was on a recovery phase driven by services sector from rising tourism numbers.

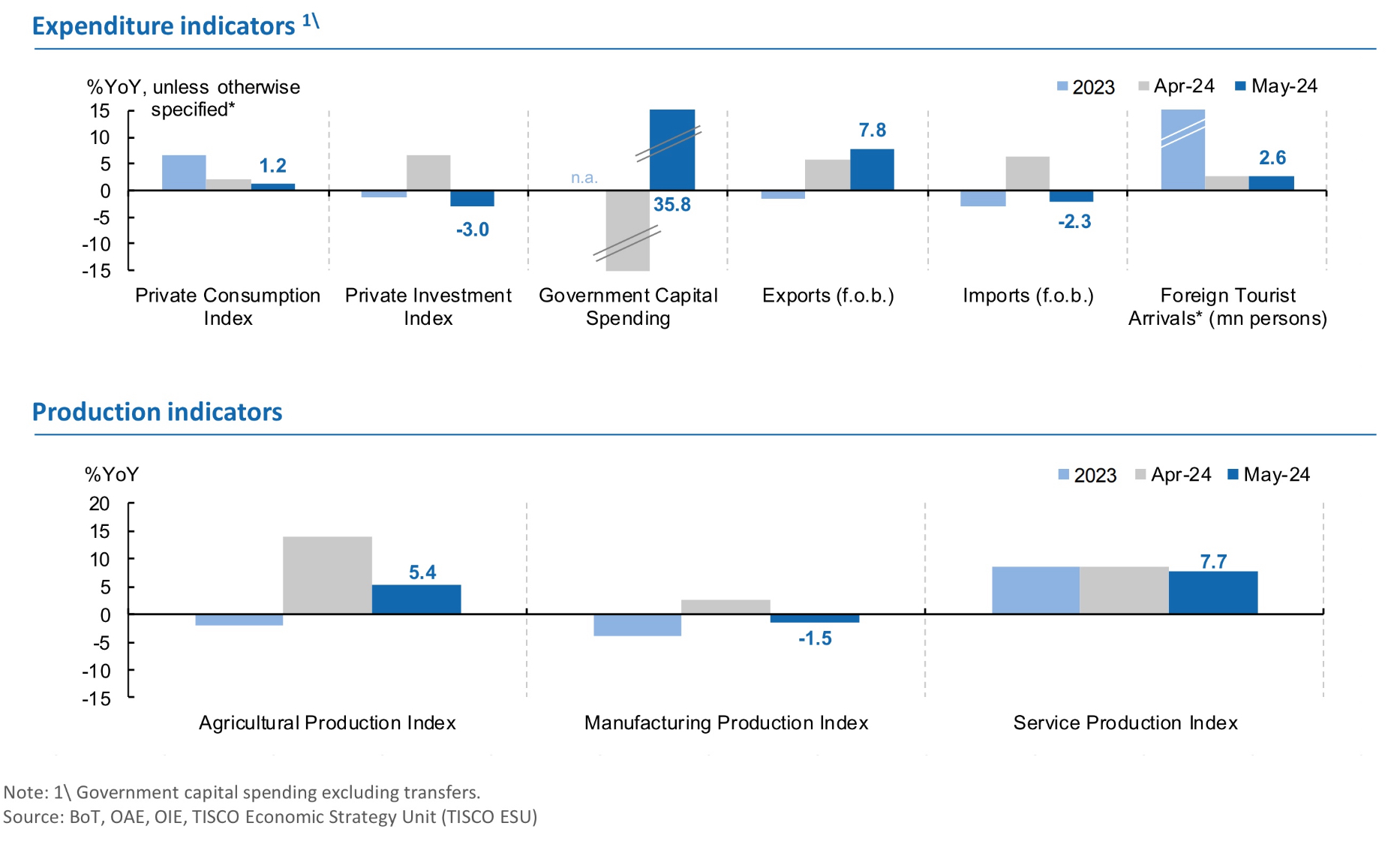

Exports continued to expand in May at +7.8% year-on-year (YoY), while imports dipped into negative territory at –2.3%. Thailand’s trade balance recorded a surplus of US$ 2.8 billion.

“The Thai economy continued to improve in May, with tourism recovery still the key driver. Disbursement of the FY2024 budget accelerated with value exceeding our expectation by roughly 5%. Private consumption showed some signs of weakness, but this was attributed to cyclical factors, such as slowdown after the ramp-up during the long holiday break in April. That said, we maintain our positive outlook for the Thai economy over the rest of the year and expect that GDP growth for 2024 will be around 2.8%,” Methas Rattanasorn, economist at Tisco Securities said in a note to clients after the data was released by the BoT on Friday.

“We reiterate our view that there should be no policy rate cut(s) by the MPC in 2024F as growth momentum is still on track while inflation movement has hovered in positive territory for two months and is likely to stay there before grinding even higher in late 3Q24.”

FY2024 Budget disbursement started to accelerate after the bill was signed into law in late April. Both current and capital expenditure were significantly higher than the previous year (+36.9% YoY and +35.8% YoY, respectively) helping offset the investment indicator, exports and manufacturing weakness.

Household consumption (PCI) grew, but at a slower pace (+1.2% YoY and +0.3% MoM vs. +2.2% YoY and +1.4% MoM prev.), consistent with declines in consumer confidence in every sub-category (total, current, and next 6 months).

Investment Theme for Q3 2024

Dan Fineman, the chief strategist at one of Thailand’s leading broker for high-net worth individuals – Kiatnakin Phatra Securities, says that the theme for Q3 2024 is the quarter is going to be the quarter when the market ‘bottoms’ out.

“We expect Q3 to be a transitional quarter for the stock exchange of Thailand (SET). After a difficult H1, we expect bottoming in the early part of the quarter, followed by a gradual uptrend. Deleveraging, structural competitiveness issues, and global investors’ preference for tech/AI will continue to weigh on the market, but some headwinds will ease or turn positive,” Phatra said in a note to clients on Friday.

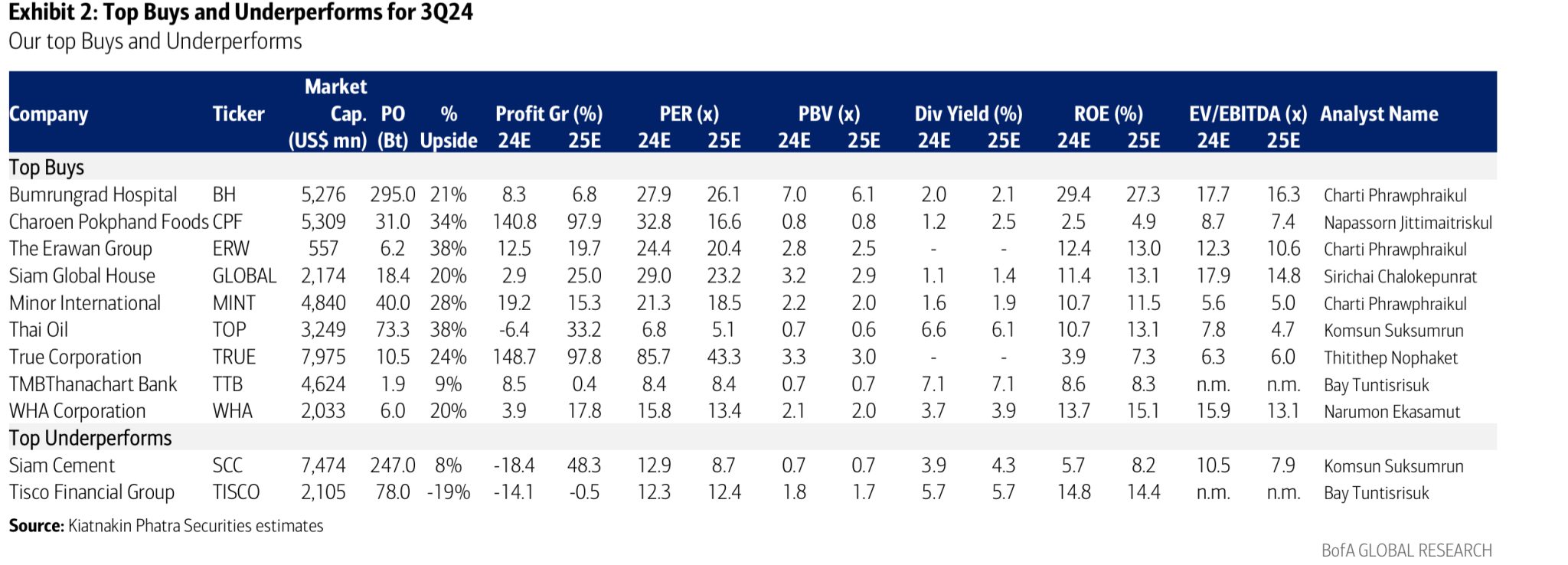

Kiatnakin Phatra says that its top 9 ‘BUY’ are BH, CPF, ERW, GLOBAL, MINT, TOP, TRUE, TTB, and WHA. Phatra’s 2 top Underperforms are SCC, and TISCO.

Kiatnakin Phatra says that fiscal expenditures started improving in May and should remain a positive force at least through Q4 2024 and possibly into Q1 2025. The delay in the passage of a budget forced the government to cut capex in September 2023-April 2024 and backload expenditures to the May-Q4 2024 period. The low base in September 2023-April 2024 will make YoY growth especially strong in Q4 2024-Q1 2025.

“At present, we do not expect the separate Digital Wallet scheme to be a market factor until 4Q or perhaps next year, but a positive surprise on early 4Q rollout is possible,” Phatra said.

Expenditures related to the backloading of the fiscal year 2024 budget will primarily relate to small-scale infrastructure, while the Digital Wallet is focused on consumption. For Q3, we focus on beneficiaries of backloading, which is already underway, but we do not yet favor potential winners of the Digital Wallet, due to uncertainty on timing and implementation.

Stock Price Info

Stock Fundamental

Peer Comparison

Stock Price Chart

The post Analysis – Thailand’s stock market is ‘bottoming’ out despite investor’s sentiments remaining subdued appeared first on Thai Enquirer.

Go to Source

Author: Thanaphum Charoensombatpanich

Thailand’s Central Bank Defies Lawmakers Refuses to Lower Interest Rates

Go to Source

Author: CTN News

Marine Le Pen’s National Rally Wins the First Round in France 2024 Election

Go to Source

Author: CTN News

BJT urges end to ‘bullying’ of senators-elect

Go to Source

Author:

Pita slams EC’s ‘double standards’

Go to Source

Author:

Group urges PM to help Moroccans held by gang

Go to Source

Author:

Thailand’s SET to Scrutinize High-Frequency Trades as Stocks Slump

Go to Source

Author: CTN News

PM vows to work harder

Go to Source

Author:

Bomb Blast Kills School Teacher Injures 16 in Thailand’s Deep South

Go to Source

Author: CTN News